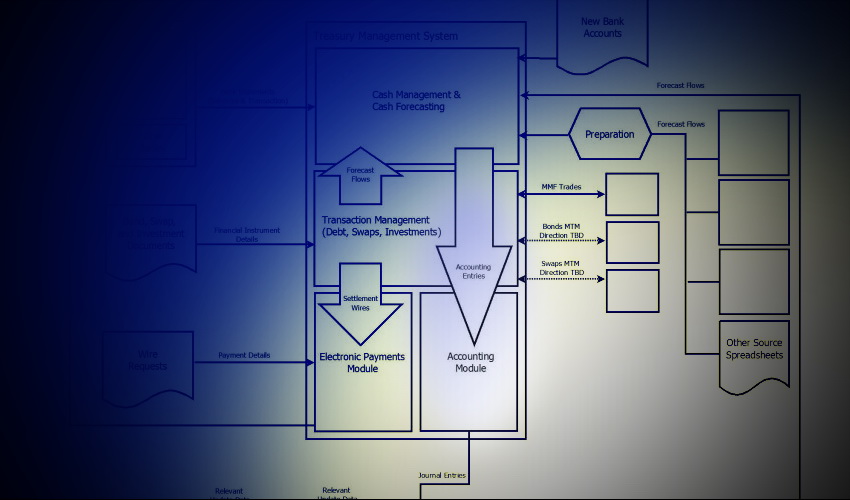

The central treasury had implemented a TMS without financial instrument modules in production.

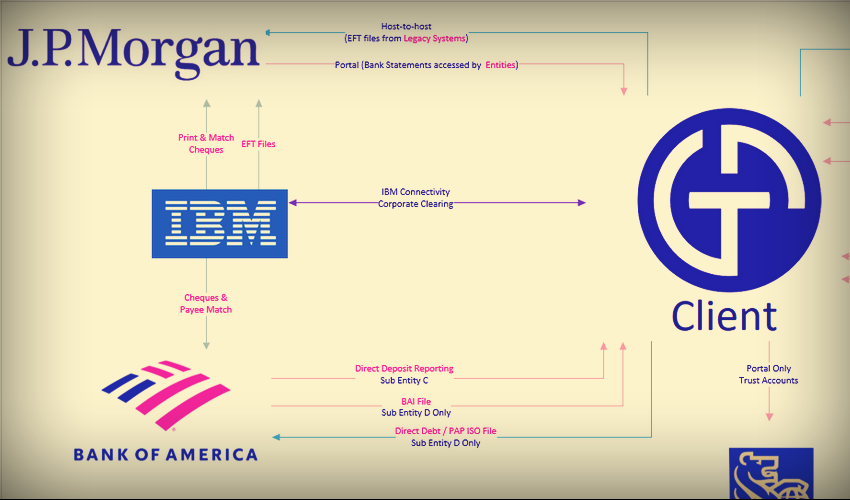

They required component forecasts from trading platforms, outside portfolio managers, a legacy financial instruments database,

manually updated reports, and an enterprise ERP. None of the data was standardized.

Cost considerations prohibited development of a full consolidation hub application.

GTP collaborated with the client's main and subsidiary IT departments

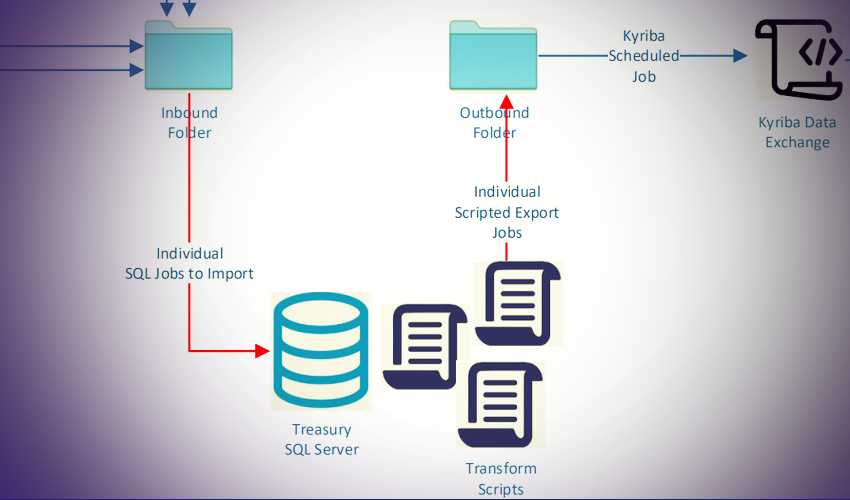

to devise a compliant solution using a combination of internally approved technologies:

SQL Server, Excel, VBA, SFTP, Active Directory, command utilities and

bulk uploaders.

GTP combined the many components into an accessible, standardized

solution and trained treasury staff to use it. IT easily adopted support because GTP used

approved technologies and followed enterprise standards and policies when working with the client's staff.

For users, GTP designed an architecture for one-touch operation.

After growing user eperience, two workstreams evolved

into zero-touch imports into the TMS. This emerged from GTP's approach of

encouraging participation and early engagement by both IT and treasury staff throughout build, deployment, testing, and cutover.

Upon client approval, GTP coded, configured, and worked with client DBAs

and network engineers to deploy file transformers for every forecast source under a uniform, compliant architecture.

Comprehensive testing was executed in collaboration with cash forecasters,

traders, and interdpertmental staff. Users were trained in one-touch operations and exception tracing.

The result was a low-cost but effective enterprise forecast consolidation process that transformed a

multiplicy of different forecast sources from

disparate locations into importable files for the central treasury's TMS.

This resulted in a disciplined, cohesively categorized emterprise cash foreast in their selected TMS.